What to Expect During Your First Meeting with a Licensed Insolvency Trustee

- Maha Sultan

- Oct 6, 2025

- 5 min read

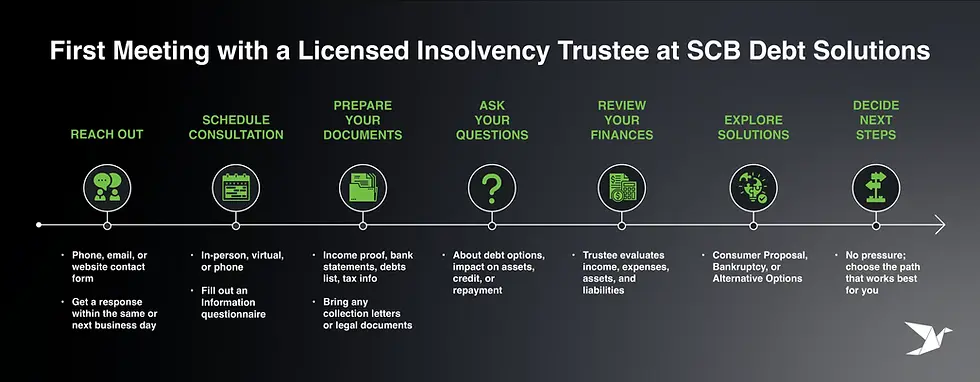

When faced with debt, life can feel overwhelming. For many people, the hardest step is simply reaching out for help. If you’ve booked your first meeting with a Licensed Insolvency Trustee (LIT), you might be feeling nervous or unsure about what’s going to happen. That’s completely normal.

The good news is that this first meeting is all about support. At SCB Debt Solutions, our goal is to make sure you walk away feeling more hopeful and confident about your financial future. Here’s a look at what you can expect.

Why Should You Meet with a Licensed Insolvency Trustee?

A Licensed Insolvency Trustee is the only professional in Canada to legally help you with solutions like consumer proposals and bankruptcy. Think of them as guides who can walk you through your options when debt feels unmanageable.

This first meeting gives you the chance to:

Get a clear picture of your finances.

Learn about all your debt relief options.

Ask questions in a safe and judgement-free environment.

Take an actionable step toward financial relief.

And you’re definitely not alone. In 2024, consumer insolvencies in Canada increased by 11.4%, reflecting growing financial stress among households.

How to Contact a Licensed Insolvency Trustee

The process begins when you reach out to a Licensed Insolvency Trustee by:

Phone: +1 (403)-261-7779

Email - kmartinez@scbsolutions.ca

Direct message

You’ll typically receive a response the same business day or the next if you contact us after hours. You can schedule your first consultation in-person, virtually, or over the phone.

If you prefer, we may send an information questionnaire to complete before the meeting. This helps the trustee understand your situation ahead of time.

How to Get Ready for the First Meeting with an LIT?

The first meeting is about understanding your situation, so gathering basic financial details ahead of time is helpful.

Collect What You Can

It helps to bring along any information you have about your finances. Items like:

Pay stubs or proof of income.

A list of your monthly expenses (rent, groceries, utilities, childcare, etc.).

Information about your debts (credit card balances, loans, taxes, etc.).

Any collection letters or legal documents.

Don’t stress if you don’t have everything perfectly organized. Your trustee will guide you and help fill in the blanks.

Write Down Your Questions

This is your chance to get answers. Some people want to know how a consumer proposal works, others worry about keeping their car or house, and many want to understand how their credit will be affected. No question is too small or silly, and your trustee is there to explain things clearly.

What Actually Happens During Your First Consultation with a Licensed Insolvency Trustee

It Begins With a Private and Friendly Conversation

Your meeting will be confidential and one-on-one. Most people enter feeling nervous but leave feeling relieved. You’ll find that the atmosphere is respectful and supportive, with options clearly laid out to help you without embarrassment or judgement.

A Look at Your Finances

The Licensed Insolvency Trustee will review your income, expenses, debts, and assets to get the full picture. This meeting will be about understanding where you are now so they can recommend the best way forward.

Exploring Your Options

Based on your situation, your trustee will walk you through the available solutions, which may include:

Consumer Proposal: A legally binding agreement to pay back part of what you owe, with no more interest and protection from creditors.

Bankruptcy: A reset option that eliminates most unsecured debts and offers a fresh start.

Other Options: Sometimes a different approach, such as budgeting strategies or debt consolidation, may be a better fit.

The goal is to make sure you fully understand your choices so you can decide what feels right for you.

Deciding on Next Steps

If you’re ready, you can move forward with a solution right away. But there’s no pressure. Many people take time to think it over and come back when they feel ready.

Ready To Feel Lighter About Your Finances?

Most people describe feeling lighter after their first consultation. Just talking through your situation with someone who understands, and learning that there are real and legal protections available, can be a huge relief and burden off your shoulders. This is where SCB Debt Solutions can step in. Not just as a service, but as a partner to guide you through one of the toughest chapters of your life, with clarity, compassion, and a clear path forward. For many, this first meeting is the turning point where debt stops feeling like an endless trap and starts feeling like a challenge they can actually overcome.

Why More and More Albertans Turn to SCB Debt Solutions

At SCB Debt Solutions, we know that debt doesn’t only affect your wallet. It can seep into your peace of mind, your relationships, and your confidence. Our Licensed Insolvency Trustees take the time to really listen and explain your options clearly, so you feel supported at every step.

Whether you’re leaning toward a consumer proposal or considering bankruptcy, we’ll help you weigh the pros and cons and make the decision that’s best for you and your family.

For helpful tips and guidance on managing debt, check out our SCB Debt Solutions blog, where we cover everything from budgeting strategies to understanding consumer proposals and bankruptcy.

Your Path to a Fresh Financial Start, Starts Today

Your first meeting with a Licensed Insolvency Trustee doesn’t have to be intimidating. In fact, most people find it’s the most hopeful step they’ve taken in a long time. It’s your chance to learn about your options, ask questions, and start building a path toward a debt-free future.

At SCB Debt Solutions, we’re here to help you through each step of the way. You don’t have to face this alone.

Are you ready to take back control of your finances?

Book your free and confidential assessment with SCB Debt Solutions today. Our Licensed Insolvency Trustees will listen, answer your questions, and help you choose the path that’s right for you. A brighter financial future is possible, and let’s take that first step together!

FAQs about Initial Consultation with an LIT

Q1. What to Look for While Choosing the Best Licensed Insolvency Trustee for your financial situation?

Look for a trustee who is federally licensed, experienced, and approachable. They should explain options clearly, answer questions without pressure, and have a strong understanding of solutions like consumer proposals or bankruptcy tailored to your financial needs.

Q2. What is the importance of initial consultation with an LIT?

The initial consultation helps you understand your financial situation, explore debt relief options, and get unbiased guidance. It’s a confidential, no-pressure meeting that allows you to make informed decisions about consumer proposals, bankruptcy, or alternative solutions.

Q3. What questions should I ask a Licensed Insolvency Trustee during the first meeting?

Some of the questions you can ask an LIT during the first consultation are:

How will this process affect my credit rating and financial future?

How long does the process typically take from start to finish?

What fees or costs will I need to pay, if any?

Are there any alternatives to bankruptcy or proposals that I should consider?

Q4. Is there any cost to schedule an initial consultation with a Bankruptcy Trustee?

The initial consultations with a Licensed Insolvency Trustee at SCB Debt Solutions is free. This confidential one-on-one meeting is designed to review your financial situation, answer your questions, and explain your options without any obligation or upfront cost.

.png)